62% of people, aged 50 to 64, do not understand Age Pension eligibility: here’s what you need to know

01/05/2024

New research by Colonial First State has discovered that most people approaching retirement age have no idea if they are entitled to the Age Pension.

The current Age Pension rules will allow a couple retiring today to have more than $1 million in assets – plus their family home – and still receive a part Pension.

“People are often surprised that they can have a substantial amount of income and/or assets and still receive at least a part age pension,” Colonial First State Head of Technical Services, Craig Day said.

MBA Financial Strategists director Darren James said many people nearing retirement were confused about commentary on whether their home was counted in pension assets tests, “or you can’t have money in the bank or can’t have any income to be eligible.”

“None are correct,” he said.

What are the current Age Pension rules around income?

A single person can have income up to approximately $63,000 per year and still receive a part Age Pension whereas a couple can have income just over $96,000 combined per year and still receive a part Age Pension.

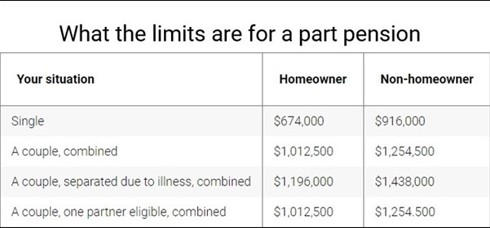

Different thresholds apply depending on whether you are a homeowner or non-homeowner, with higher thresholds for non-homeowners.

If you are a single homeowner, the value of your home doesn’t count as an asset, and you will be eligible for at least a part Age Pension if your assets are below $674,000.

For single non-homeowners, the cut off threshold is $916,000.

Busting myths around Age Pension eligibility

The message?

Seek financial advice when planning for retirement as there are strategies that could potentially have a significant impact on Pension payments and income.

“If you have a younger spouse, you have the ability to shelter assets in superannuation and make yourself more eligible than you otherwise would be,” Darren said.

Money held in super is effectively hidden from Centrelink means testing until age 67, so a couple with a younger partner can potentially put a large chunk of the Pension-age partner’s money into the younger person’s super.

You can make a super contribution directly to your spouse's super, treated as their non-concessional contribution, which may entitle you to a tax offset. You can also set up one-off or recurring payments into your younger partner's super account via BPAY or bank transfer.

Darren said people should research their options and consider using calculators at servicesaustralia.gov.au and my.gov.au.

Other concessions available

Even if you are not eligible for an Age Pension, there may be other benefits that you can access such as concession cards.

For instance, the Commonwealth Seniors Health Card provides cheaper medicines and does not have an assets test – only an income test where a single must earn below $95,400 and a couple below $152,640 a year.

The information provided is for informational purposes only and should not be considered as financial advice. Consult with a professional before making any financial decisions.